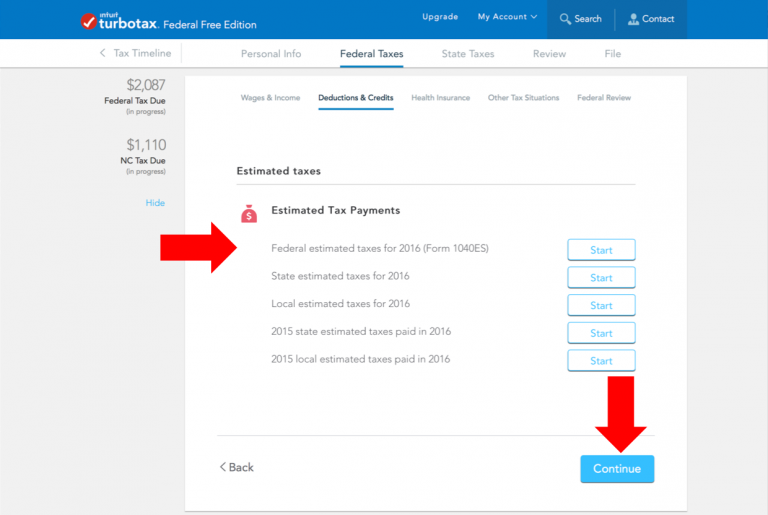

We don't refund or reduce convenience fees for overpayment of taxes, nor does the service provider. You can submit your quarterly payments online through the Electronic Federal Tax Payment System or pay them using paper forms available from the IRS. We issue refunds by check or as otherwise authorized by Oregon law. Office of the City Auditor Income Tax Division Payment of Assessments Declaration of Estimated Tax for Individuals and Businesses Quarterly Statement of. Under Oregon law, we only issue tax refunds to taxpayers after a claim for refund is submitted and validated. Keep this number as proof of payment. When paying estimated tax or extension payment, you aren't required to file a couple or the Oregon-only extension form. Once your transaction is processed, you'll receive a confirmation number. If youre at risk for an underpayment penalty next year, well automatically calculate quarterly estimated tax payments and prepare vouchers (Form 1040-ES). The service provider will tell you the amount of the fee during the transaction.

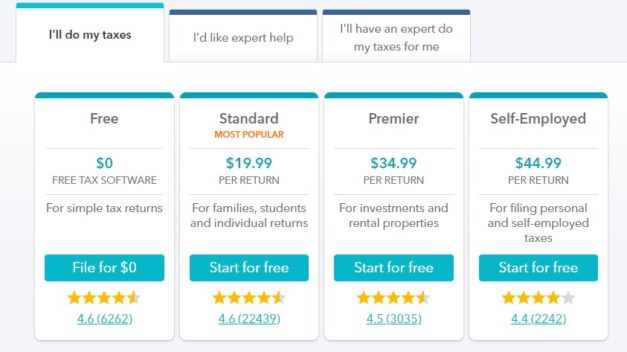

The fee is based on the amount of your payment. If a due date falls on a weekend or legal holiday. Our favorites are QuickBooks Desktop Pro, QuickBooks Self-Employed, and Sage 50cloud. Estimated tax payments are typically made incrementally, on quarterly tax dates: April 15, June 15, Sept.

#Does turbotax help with quarterly taxes software

You may be charged a service fee by the service provider if you choose this payment option. The best tax accounting software includes support for multiple tax forms, estimated quarterly taxes, and e-filing. We accept Visa, Mastercard, and Discover. Send the completed Form D-2210, along with your notice of tax due and any payment due with your return.You can use your credit or debit card to pay your taxes. You may also fill out Form D-2210 if you think OTR has miscalculated your bill.ĥ. However, since OTR's computerized tax system assumes four equal quarterly payments, you would definitely benefit from filling out Form D-2210, using the annualized income method, if most of your income tends to be received late in the year.

For example, if your income is regular throughout the year, it is not necessary to calculate your own underpayment penalty – OTR can do it for you and send you a bill. As a taxpayer, you must make quarterly estimated tax payments if the expected tax due on your taxable income not subject to withholding is more than 400.

You should not fill out Form D-2210 unless it is to your advantage to do so. In other words, you must pay 25 percent of your obligation by the first quarter, 50 percent by the second quarter, 75 percent by the third quarter, and 100 percent by the fourth quarter.Ĥ. You will note in Form D-2210 that both required payments and actual payments made are treated cumulatively. Note: You must have been a DC resident for the entire 12-month prior year to use provision (2).

#Does turbotax help with quarterly taxes plus

There are two keys to understanding the D-2210:įor most taxpayers (whose income is regular throughout the year) your total payment for each quarter (the total of withholding plus estimated tax payments) must equal 25 percent of either: (1) 90 percent of the current year’s tax obligation, or (2) 110 percent of last year’s tax obligation for the entire 12-month period. Form D-2210 helps you calculate your required quarterly estimated tax payments, plus any penalties resulting from underpayment of these required quarterly payments. The annualized income method allows you to make estimated payments based on the actual percentage of annual income received in a given quarter.ģ. However, if you tend to receive the bulk of your income late in the tax year, you are better off using the annualized income method and filing a completed Form D-2210 with your annual return. If your income is regular throughout the year, and you are not covered by withholding, then you would make four equal quarterly payments of estimated tax. Enlist the help of a Block Advisors small. You're self-employed When you're self-employed, federal, state, and Social Security taxes aren't taken out of the income you receive. OTR will not charge a penalty if these required estimated payments are made on time and the amount owed at the end of the year is less than $100.Ģ. Here you can make payments weekly, quarterly, or monthly, and you can set up payments up to a year in advance. If taxes aren't withheld from the income you receive, making quarterly estimated tax payments can help you avoid paying a big tax bill or an underpayment penalty in April. Therefore, if your annual tax liability is not fully covered by withholding, or if you have no withholding, you must make quarterly estimated tax payments. For example, an individual who earns a significant amount of income in a given year must, by both federal and DC law, pay tax on that income as it is earned, rather than waiting until the next year, when the return is filed on April 15.

0 kommentar(er)

0 kommentar(er)